The hidden rate premium that erases most “payment savings” A 50-year mortgage spreads payments over…

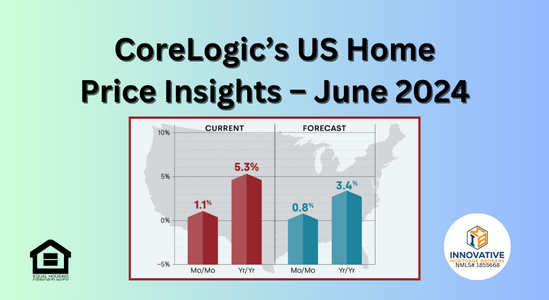

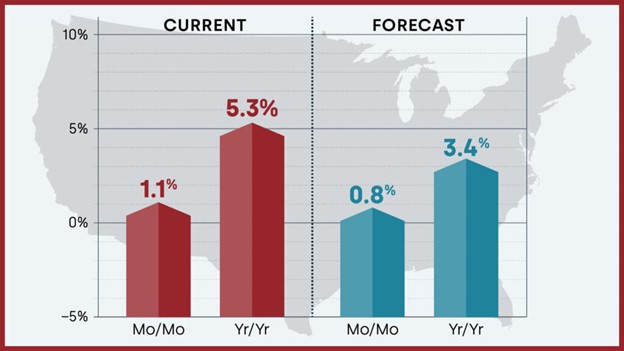

U.S. Home Prices Continue to Climb: Insights from CoreLogic June 2024 Report

The CoreLogic June 2024 Home Price Insights report provides an in-depth analysis of the current state and future projections of the U.S. housing market. According to the report, national home prices, including distressed sales, increased by 5.3% year-over-year in April 2024. Here we break down the key findings and projections from the report.

National and Regional Trends

Year-Over-Year and Month-Over-Month Increases

National home prices increased by 5.3% in April 2024 compared to April 2023. Month-over-month, prices grew by 1.1% from March to April 2024. CoreLogic forecasts a modest rise of 0.8% from April to May 2024 and a 3.4% increase year-over-year by April 2025.

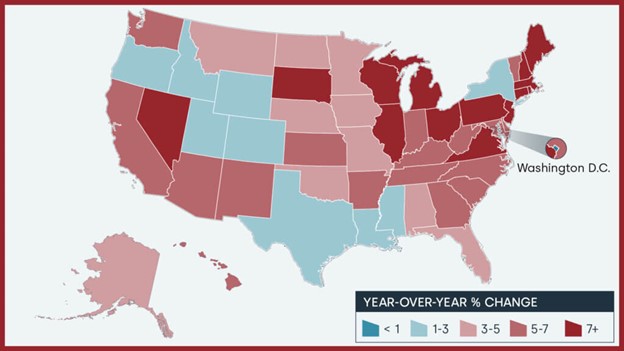

State-Level Insights

No states experienced declines in home prices year-over-year. The states with the highest increases were New Hampshire (12%), New Jersey (11%), and South Dakota (10.8%).

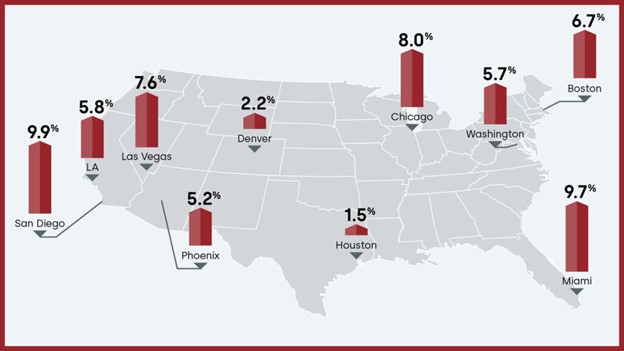

Metropolitan Area Highlights

Among the top 10 metros, San Diego led with a 9.9% increase in home prices year-over-year. Other notable metros included Miami and Denver, showing significant growth.

Cooling Market and Affordability Challenges

CoreLogic projects a slowdown in home price growth by Spring 2025, with national gains expected to cool to 3.4%. The report highlights that elevated mortgage rates, around 7%, are a major factor influencing housing affordability, cooling typical spring homebuyer demand.

Impact of Interest Rates

The report emphasizes the sensitivity of homebuyers to rising interest rates. The April uptick in mortgage rates to this year’s high has cooled demand, impacting monthly gains. The anticipation of lower rates in the future may help ease the affordability crunch.

Market Risk Indicators

The CoreLogic Market Risk Indicator (MRI) predicts that Palm Bay-Melbourne-Titusville, FL, faces a very high risk (70%+ probability) of a home price decline over the next 12 months. Other high-risk markets include Atlanta, Spokane, and Naples.

High-Risk Market Analysis

In high-risk markets like Palm Bay-Melbourne-Titusville, the likelihood of price declines is influenced by several factors. These include local economic conditions, employment rates, and the balance between housing supply and demand. For instance, markets with significant new construction and a slower job market may see more pronounced declines.

Housing Inventory and Market Dynamics

The report also highlights the role of housing inventory in price dynamics. A slight increase in available homes for sale has contributed to a more balanced market. However, the overall inventory remains tight, which supports ongoing price growth, albeit at a slower rate.

Regional Inventory Variations

Inventory levels vary significantly across regions. While some areas have seen a modest increase in listings, others, particularly in high-demand metros, continue to experience shortages. This imbalance affects local price trends and buyer behavior.

Affordability and Buyer Behavior

Affordability remains a critical concern as high home prices and mortgage rates strain potential buyers’ budgets. First-time homebuyers and those in lower-income brackets are particularly affected. The report suggests that this could lead to a shift in buyer preferences towards more affordable, smaller homes or properties in less expensive areas.

Demographic Shifts

Demographic changes also play a role in market dynamics. Millennials, now entering their prime homebuying years, continue to drive demand. However, their buying power is often constrained by student loan debt and higher living costs, influencing the types of properties they seek.

Future Market Outlook

Looking ahead, CoreLogic’s forecast suggests a gradual moderation in price growth. This is attributed to expected stabilization in mortgage rates and a slight increase in housing supply. However, regional variations will persist, with some areas continuing to see robust growth while others stabilize or decline.

Economic Influences

The broader economic environment, including employment trends, wage growth, and inflation, will significantly impact the housing market. Positive economic indicators could support stronger housing demand, while economic uncertainty or a slowdown could dampen it.

Potential Impact of Lower Mortgage Rates on Housing Demand

If mortgage rates decrease from their current elevated levels, the housing market could experience significantly higher demand than the anticipated 3.4% growth mentioned above. Lower mortgage rates reduce the cost of borrowing, making homeownership more affordable for a larger segment of buyers. This affordability boost could reignite demand among first-time homebuyers and those looking to upgrade or invest in real estate. Additionally, lower rates often lead to increased refinancing activity, further stimulating the housing market. As a result, price growth could exceed CoreLogic’s projections, leading to more robust market activity and potentially faster price appreciation in various regions.

Factors Influencing Increased Demand

Several factors would contribute to heightened demand if mortgage rates decrease:

- Affordability: Reduced monthly mortgage payments would make homes more accessible to a broader range of buyers.

- Refinancing Surge: Homeowners looking to take advantage of lower rates may refinance, injecting more capital into the market.

- Investor Activity: Lower borrowing costs could attract more real estate investors, increasing competition for available properties.

- Economic Confidence: Lower rates may boost consumer confidence, encouraging more people to enter the housing market.

Regional Variations in Response

While the overall market would likely see increased demand, the impact may vary by region. Areas with already high demand and limited supply, such as major metropolitan markets, could see the most significant price gains. Conversely, regions with more balanced markets may experience more moderate increases. Understanding these regional dynamics is crucial for individuals looking to navigate the evolving housing landscape.

Conclusion

The CoreLogic June 2024 Home Price Insights report provides valuable insights into the current and projected state of the U.S. housing market. While national home prices continue to rise, the growth rate is expected to slow down due to high mortgage rates and increasing inventory. For more detailed information, visit the CoreLogic report.