Our new portal lets you securely check progress, milestones, and next steps anytime you want…

Navigating Affordable Mortgage Options in Pennsylvania: Conventional and FHA Loan Options Explained

Are you considering buying a home in Pennsylvania, but unsure which mortgage option suits you best? Understanding the differences between conventional and FHA loan options can make a world of difference in your homebuying journey. Let’s break down these two popular mortgage types to help you make an informed decision.

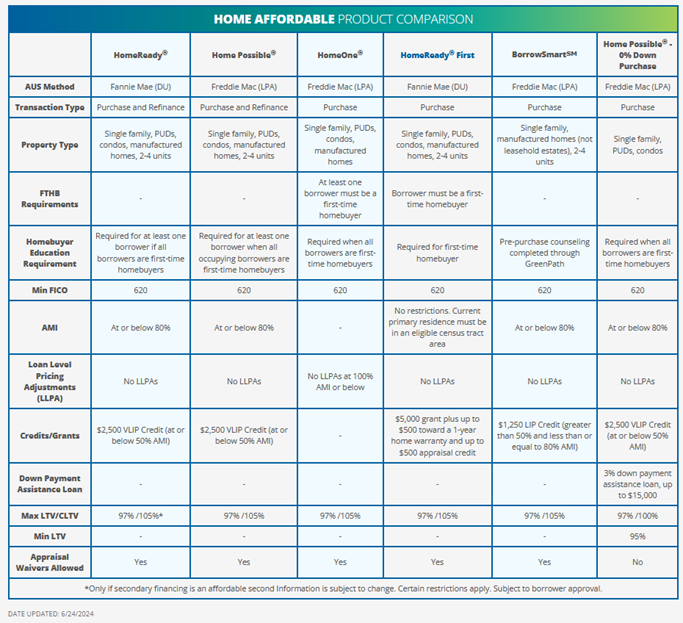

Conventional Mortgage Programs: Tailored for Diverse Needs

Conventional 97 Loan

- Down Payment: As low as 3%

- Who’s It For? First-time homebuyers or those who haven’t owned a home in the last three years.

- Mortgage Insurance: Required if your down payment is less than 20%. The good news? It can be canceled once you reach 20% equity in your home.

- Why Choose It? The Conventional 97 Loan offers a lower down payment and more flexible terms compared to traditional conventional loans, making it an attractive option for many buyers.

Fannie Mae HomeReady

- Down Payment: As low as 3%

- Who’s It For? Low-to-moderate income borrowers, including both first-time and repeat homebuyers.

- Income Limits: Must meet area median income (AMI) requirements.

- Why Choose It? Reduced mortgage insurance costs and flexible funding options for your down payment (gifts, grants, or Community Seconds® are welcome). Plus, non-borrower household income can help you qualify.

Freddie Mac Home Possible

- Down Payment: As low as 3%

- Who’s It For? Similar to HomeReady, it’s designed for low-to-moderate income borrowers, whether first-time or repeat buyers.

- Income Limits: Must meet AMI requirements.

- Why Choose It? Offers reduced mortgage insurance costs, flexible down payment sources, and considers non-borrower household income for qualification.

Why Choose a Conventional Loan? Conventional loans are known for their flexibility and varied options. These loans are not insured by the federal government, which means they can be customized more extensively by lenders. For those with good credit and the ability to make a larger down payment, conventional loans often provide better terms and fewer restrictions.

- Flexible Terms and Conditions: You can choose from a wide range of loan terms, typically from 10 to 30 years, and either fixed or adjustable rates. This allows you to tailor your mortgage to fit your financial goals.

- Avoiding Mortgage Insurance: By making a 20% down payment, you can avoid the cost of private mortgage insurance (PMI), which can significantly reduce your monthly payments.

- Potentially Lower Interest Rates: Borrowers with excellent credit scores may qualify for lower payments compared to those available with FHA loans.

FHA Mortgage Programs: Flexible Options for Varied Credit Profiles

Standard FHA Loan

- Down Payment: As low as 3.5%

- Credit Score: Typically requires a minimum credit score of 580 (or as low as 500 with a 10% down payment).

- Mortgage Insurance: Includes an upfront Mortgage Insurance Premium (UFMIP) of 1.75% of the loan amount and an annual Mortgage Insurance Premium (MIP), varying based on loan terms.

- Why Choose It? FHA loans are known for their lenient credit requirements, allowing higher debt-to-income ratios and accepting down payment gifts from family or grants.

FHA 203(k) Rehabilitation Loan

- Down Payment: As low as 3.5%

- Purpose: Combines your mortgage and home repair costs into one loan.

- Why Choose It? Perfect for those eyeing a fixer-upper, as it covers a range of home improvements from minor repairs to major renovations.

FHA Energy Efficient Mortgage (EEM)

- Down Payment: As low as 3.5%

- Purpose: Finances energy-efficient improvements within your FHA loan.

- Why Choose It? Helps you save on utility bills, making homeownership more affordable over time.

FHA Streamline Refinance

- Purpose: Simplified refinancing process for existing FHA borrowers to lower interest rates and monthly payments.

- Why Choose It? Requires minimal documentation, no appraisal, and offers faster processing.

Why Choose an FHA Loan? FHA loans are designed to make homeownership accessible to more people, especially those with less-than-perfect credit or limited funds for a down payment. These loans are insured by the Federal Housing Administration, which reduces the risk for lenders and allows them to offer more favorable terms.

- Lower Credit Score Requirements: FHA loans are ideal for borrowers with lower credit scores, often accepting scores as low as 580 for a 3.5% down payment.

- Lower Down Payments: With down payments as low as 3.5%, FHA loans make it easier to save for your new home.

- Assistance with Down Payments: FHA loans allow for down payment assistance from various sources, including family gifts and government grants.

- Flexible Qualification Guidelines: FHA loans have more flexible guidelines when it comes to debt-to-income ratios, making it easier to qualify even with existing debt.

Comparing Conventional and FHA Loans

Credit Requirements

- Conventional Loans: Typically require higher credit scores (620 and above) for better terms.

- FHA Loans: Can accept lower credit scores (as low as 500 with a higher down payment).

Down Payments

- Conventional Loans: As low as 3% with Conventional 97, but generally 5-20% is common.

- FHA Loans: As low as 3.5%.

Mortgage Insurance

- Conventional Loans: PMI is required if the down payment is less than 20%, but it can be canceled once you reach 20% equity.

- FHA Loans: Requires UFMIP and MIP for the life of the loan unless refinancing into a conventional loan.

Loan Limits

- Conventional Loans: Higher loan limits compared to FHA.

- FHA Loans: Loan limits vary by county and tend to be lower than conventional loan limits.

Interest Rates

- Conventional Loans: Generally, borrowers with excellent credit may receive lower monthly payments.

- FHA Loans: Rates are competitive, but payments may be slightly higher than conventional loans for borrowers with excellent credit.

About Us: Innovative Mortgage Brokers

At Innovative Mortgage Brokers, we are committed to helping you achieve your homeownership dreams with ease and confidence. Based in Philadelphia, we extend our services throughout Pennsylvania and Florida, offering tailored mortgage solutions that suit your unique needs.

Our Mission Our mission is to simplify the mortgage process and make homeownership accessible to everyone. We believe in providing transparent, personalized service, ensuring you understand every step of the journey.

Our Services We specialize in a wide range of mortgage options, including conventional, FHA, USDA, and Non-QM loans. Whether you’re a first-time homebuyer, an investor, or looking to upgrade your current home, we have the expertise to find a competitive mortgage solution for you. We also offer refinancing services to help you lower your monthly payments or tap into your home’s equity as well.

Why Choose Us?

- Experience: With many years in the mortgage industry, we have the knowledge and experience to navigate even the most complex situations.

- Personalized Service: We take the time to understand your financial goals and tailor our services to meet your needs.

- Competitive Rates: We offer competitive rates, helping you save money over the life of your loan.

- Education and Transparency: We are committed to explaining things simply and clearly, ensuring you feel confident in your decisions.

Our Team is dedicated to providing friendly, professional, and efficient service. We are passionate about helping you achieve your homeownership goals and are here to guide you every step of the way.

Contact Us Ready to take the next step in your homebuying journey in Pennsylvania or Florida? Contact us today to schedule a consultation and explore your mortgage options. Let’s make your dream of homeownership a reality, together.

Making the Right Choice

Choosing between a conventional and an FHA loan depends on your financial situation, credit history, and homeownership goals. Conventional loans are often ideal for those with good credit and the ability to make a larger down payment. On the other hand, FHA loans offer more flexibility, making them a better fit for buyers with lower credit scores and smaller down payments.

At Innovative Mortgage Brokers, we understand that every homebuyer’s situation is unique. If you’re still unsure which loan option is right for you, our team is here to help. We’ll work with you to explore your options and find the best fit for your needs in Pennsylvania and Florida.

Ready to take the next step in your homebuying journey? Reach out to us today for personalized guidance and support. Let’s make your dream of homeownership a reality, together.

FAQs

Q: What is the minimum credit score required for a conventional loan? A: Most conventional loans require a minimum credit score of 620, but higher scores will get you better terms.

Q: Can I get an FHA loan with bad credit? A: Yes, FHA loans are designed to accommodate borrowers with lower credit scores, sometimes as low as 500 with a higher down payment.

Q: What are the benefits of a Conventional 97 loan? A: The Conventional 97 loan offers a low down payment of just 3%, making it a great option for first-time homebuyers with good credit.

Q: How can I cancel PMI on a conventional loan? A: PMI on a conventional loan can be canceled once you have 20% equity in your home.

Q: Are there any income limits for FHA loans? A: No, FHA loans do not have income limits, but they do have loan limits which vary by county.

For more detailed information or specific questions, feel free to contact us at Innovative Mortgage Brokers. We’re here to help you navigate the homebuying process with ease.