Flexible Commercial Mortgage Solutions for Real Estate Investors and Small Business Owners

Are you looking to finance a commercial property but finding that traditional bank loans don’t fit your needs? At Innovative Mortgage Brokers, we provide flexible commercial loan solutions tailored to independent investors, entrepreneurs, and business owners who need more than what conventional banks offer. Whether you’re purchasing a new property, refinancing, or tapping into cash-out options, our programs support diverse real estate goals.

Who We Serve

We specialize in serving clients who may not fit the typical mold for bank loans. Whether you’re a first-time investor, self-employed, or a seasoned real estate professional, we offer financing options that meet you where you are:

- Mixed-Use Properties: These are properties with multiple units zoned for different uses, like residential and commercial spaces combined. We provide financing solutions tailored for these unique properties, making it easy for investors to access funds.

- Multi-Family Units: If you’re investing in properties with five or more units, our commercial programs offer financing designed for larger residential investments.

- Commercial Buildings: We cover a wide variety of commercial properties, including office buildings, retail spaces, warehouses, automotive repair shops, self-storage facilities, and more. Even properties with unique usage types, like restaurants or daycare centers, are eligible for our flexible financing options.

Flexible Loan Options for All Property Types

Our loan programs cater to a wide range of needs, including:

- Owner-Occupied Properties: Secure financing for properties you plan to use for your business operations.

- Investment Properties: Ideal for real estate investors, we offer funding solutions that work for properties meant solely for investment purposes, whether residential or commercial.

Our available options include:

- Purchase Loans: For clients ready to acquire a new commercial property.

- Rate and Term Refinance: To help you secure better terms or reduce monthly payments.

- Cash-Out Refinance: Unlock your property’s equity to reinvest in other opportunities or cover expenses.

Why Choose Innovative Mortgage Brokers?

Working with us means partnering with a team dedicated to making the mortgage process smooth and efficient. Here’s how we make a difference:

- Lower Documentation Requirements: Unlike traditional banks, we streamline the application process. This is especially helpful for self-employed borrowers or those with non-traditional income, such as business bank statements.

- Competitive Rates: With access to a network of nationwide lenders and direct lending partners, we offer some of the most competitive rates. Whether you need a fixed rate or interest-only options, we can help you find the best terms.

- High Loan-to-Value (LTV) Ratios: We offer competitive Loan-to-Value (LTV) ratios based on property type and credit profile, allowing you to secure substantial financing for your investments. Our high LTV options are available, giving you access to the financing you need to bring your investment goals within reach.

Specialty Programs for Unique Borrowing Needs

We provide tailored financing solutions designed to accommodate various investment strategies and borrower needs. Whether you’re looking for long-term stability with fixed-rate options, short-term solutions focused on enhancing property value, or quick approvals with simplified requirements, our range of flexible loan structures allows you to choose terms that best align with your financial goals. From interest-only payments to fully amortized options, we offer adaptable choices to support your unique investment plans.

Underwriting Made Simple

Our underwriting guidelines allow for flexible financing options with fewer restrictions:

- No Balloon Payments: Most of our loan options avoid balloon payments, ensuring consistent terms without the stress of large, one-time payments at the end.

- Prepayment Flexibility: Many of our loans include minimal or no prepayment penalties, making it easy to pay off your loan early without penalties.

- Experience-Based LTV Adjustments: For experienced investors, we offer higher LTVs, allowing repeat borrowers with a solid investment history to benefit from reduced down payments.

Steps to a Smooth Loan Process

With Innovative Mortgage Brokers, we focus on making your commercial mortgage journey as smooth as possible. Here’s what you can expect when working with us:

- Quick Pre-Qualification: Find out how much you can borrow with a simple, streamlined pre-qualification process.

- Clear Documentation Requirements: Unlike traditional banks, we reduce the paperwork burden, often requiring only key documents like recent tax returns or business bank statements.

- Transparent Communication: From application to closing, we keep you informed every step of the way. You’ll have access to your loan officer, who is ready to answer any questions.

Let’s Help You Make the Right Move

If you are looking to finance a commercial property, let Innovative Mortgage Brokers make the process easy and accessible. Our team specializes in commercial mortgage financing for many property types. With flexible terms, competitive rates, and a simplified application process, we’re ready to help you take the next step in your real estate investment journey.

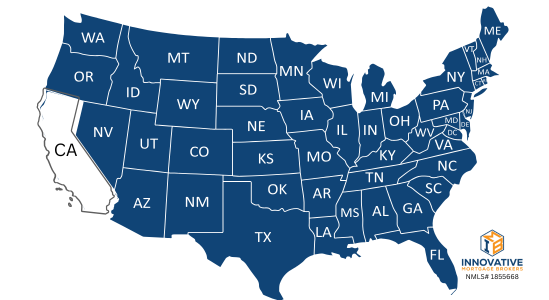

Nationwide Reach for Commercial Loans

One of the standout benefits of working with Innovative Mortgage Brokers is our ability to assist with commercial financing across many states. Unlike residential loans, which often come with location-specific restrictions, our commercial loan solutions are available in various markets, allowing us to support investors and business owners no matter where they’re looking to grow.

Whether you’re expanding your portfolio with a multi-family property, setting up a new business location, or refinancing existing commercial assets, our team is here to provide solutions tailored to meet your needs in multiple states. This nationwide reach means you have access to the same flexible terms, competitive rates, and tailored support whether you’re investing close to home or in a completely new market.

At Innovative Mortgage Brokers, we’re dedicated to helping you succeed beyond borders, making it easier to bring your commercial real estate goals to life.

Ready to Take the Next Step?

Explore our flexible loan programs, competitive rates, and dedicated support. Contact us today to learn how our commercial mortgage solutions can help bring your vision to life!

We can help with small commercial properties in most of the states

Alabama, Alaska, Arizona, Arkansas, Colorado, Connecticut, Delaware, District of Columbia, Florida, Georgia, Hawaii, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Maryland, Massachusetts, Michigan, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Hampshire, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, Rhode Island, South Carolina, South Dakota, Tennessee, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, Wyoming