Mortgage rate volatility, oil shocks, and why execution matters more than quotes When a war…

FHFA Announces Increased Conforming Loan Limits for 2025

Now Accepting Higher Loan Limits, Higher Possibilities

In a significant move to bolster homeownership and accommodate rising property values, the Federal Housing Finance Agency (FHFA) has announced an increase in the conforming loan limits for Fannie Mae and Freddie Mac for the year 2025. This adjustment reflects the ongoing appreciation in the housing market and aims to provide borrowers with greater access to mortgage financing under more favorable terms.

New Conforming Loan Limits for 2025

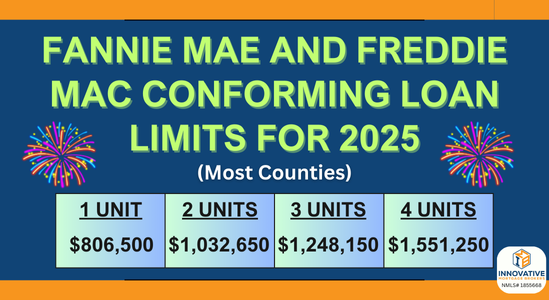

The updated loan limits for conforming mortgages are as follows:

- 1-Unit Properties: 💰 $806,500

- 2-Unit Properties: 💰 $1,032,650

- 3-Unit Properties: 💰 $1,248,150

- 4-Unit Properties: 💰 $1,551,250

These increases represent a substantial rise from the previous limits, enabling borrowers to finance higher-priced homes without resorting to jumbo loans, which often come with stricter requirements and higher interest rates.

Understanding Conforming Loan Limits

Conforming loan limits are the maximum loan amounts that government-sponsored enterprises (GSEs) like Fannie Mae and Freddie Mac will purchase or guarantee. Loans under these limits are termed “conforming loans” and typically offer borrowers advantages such as lower interest rates, reduced down payment requirements, and more lenient credit standards compared to non-conforming or jumbo loans.

Implications of the Increased Limits

Enhanced Purchasing Power

Homebuyers can now consider more expensive properties while still benefiting from the favorable terms associated with conforming loans. This is particularly advantageous in high-cost areas where property values have surged.

Lower Interest Rates

Conforming loans generally come with lower interest rates compared to jumbo loans. Borrowers can save significantly over the life of the loan due to reduced interest expenses.

Easier Qualification

The underwriting guidelines for conforming loans are often less stringent than those for jumbo loans. This means more borrowers may qualify for financing, even if they have less-than-perfect credit histories.

Reduced Down Payment Requirements

Conforming loans may require down payments as low as 3%, making homeownership more accessible, especially for first-time buyers who may struggle to amass large sums for down payments.

Impact on the Housing Market

The increase in loan limits is expected to stimulate the housing market in several ways:

- Boosting Home Sales: With higher loan limits, more buyers can enter the market, increasing demand for homes across various price ranges.

- Supporting Property Values: Enhanced borrowing capacity can help sustain or elevate property values by accommodating the financing needs of buyers in higher price brackets.

- Encouraging New Construction: Builders may be incentivized to develop more housing units, knowing that potential buyers have greater access to financing.

Considerations for Borrowers

While the increased limits offer numerous benefits, borrowers should remain mindful of the following:

- Debt Management: Higher loan amounts mean larger monthly payments. It’s crucial to assess one’s financial situation to ensure that mortgage obligations remain manageable.

- Interest Rate Environment: Keep an eye on interest rate trends. Locking in a rate at the right time can lead to long-term savings.

- Creditworthiness: Maintain a strong credit profile to qualify for the best possible terms under the new loan limits.

Why the Increase Matters

The adjustment of conforming loan limits is a response to the appreciating home prices nationwide. As the median home price continues to rise, previous loan limits may have been insufficient for average buyers, pushing them into the jumbo loan category unintentionally. By raising the limits, the FHFA ensures that conforming loans remain relevant and effective tools for facilitating homeownership.

How Innovative Mortgage Brokers Can Help

At Innovative Mortgage Brokers, we understand the nuances of the mortgage industry and are poised to help you navigate these new changes in Pennsylvania (PA) or Florida (FL):

- Personalized Consultation – Our team offers individualized consultations to assess your needs

- Access to Competitive Rates – With a network of diverse lenders, we can shop around to find the most competitive interest rates and loan terms that suit your specific needs.

- Streamlined Application Process – We simplify the mortgage application process, handling the paperwork and coordination with lenders and underwriters to make your experience as smooth as possible.

- Guidance – Stay informed with our expertise on market trends, interest rate movements, and loan products to make educated decisions about your mortgage.

Success Stories

Many of our clients have benefited from our services, especially in light of changing loan limits:

- First-Time Homebuyers: We’ve helped newcomers to the market secure financing for their dream homes without overextending their budgets.

- Upgrading Homeowners: Clients looking to move into larger or more expensive homes have leveraged the increased limits to obtain favorable loan terms.

- Real Estate Investors: We have helped investors to expand their portfolios while keeping financing costs low.

Conclusion

The FHFA’s decision to increase the conforming loan limits for 2025 is a significant development for the housing market and prospective homeowners. It opens doors for many to achieve their homeownership goals under more favorable financial conditions.

If you’re considering purchasing a home or refinancing an existing mortgage in Pennsylvania (PA) or Florida (FL), now is an opportune time to explore your options. The increased loan limits could make your mortgage more affordable than ever.