Mortgage rate volatility, oil shocks, and why execution matters more than quotes When a war…

Home Prices Are Dropping? Not So Fast!

Why Home Values Are Still Rising, Even If Median Prices Aren’t

Recent headlines have been buzzing with news about the median asking price of homes dropping compared to last year, which has sparked some confusion for both buyers and sellers. At first glance, it’s easy to assume that prices overall are declining, but there’s more to the story. In reality, home values are actually rising, even though the median price has dipped slightly. Here’s why the headlines may not be telling the full story.

Smaller Homes Are Driving the Median Price Down

The main reason behind the drop in median price is the size of the homes currently on the market. The median price reflects the middle point of all homes for sale at a given time, and that can vary based on the types of homes available.

Right now, there are more smaller, less expensive homes on the market, which is pulling the median price down. But that doesn’t mean home values themselves are falling. As Danielle Hale, Chief Economist at Realtor.com, explains, the increase in smaller, more affordable homes “helps hold down the median price even as per-square-foot prices grow further.”

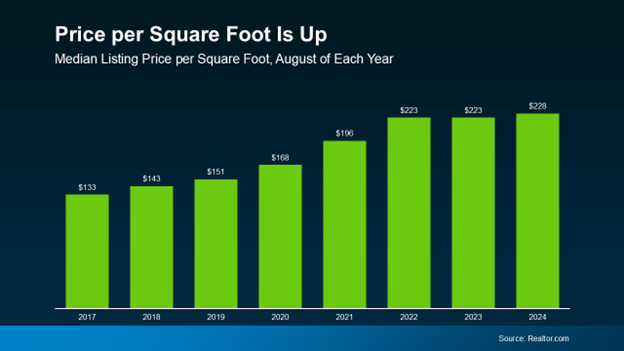

Price Per Square Foot Is the Key Indicator of Value

One of the best ways to assess home values is by looking at the price per square foot. This metric gives a clearer picture of how much buyers are paying for the space inside the home, which is a more reliable indicator of value.

While the median price might be falling due to a higher number of smaller homes on the market, price per square foot data shows that home values are still on the rise. According to Ralph McLaughlin, Senior Economist at Realtor.com, when the size of homes is factored in, the typical home’s asking price is actually higher than last year.

Why Home Values Are Still Increasing

Although the median asking price has dropped, it’s important to understand that home values are still appreciating nationally. According to the Federal Housing Finance Agency (FHFA), the U.S. housing market has experienced positive annual appreciation every quarter since 2012.

This shows that despite what the headlines suggest, home prices are not crashing. Instead, the shift in the types of homes being listed—particularly smaller and more affordable properties—is what’s pulling down the median price. In reality, the market is still strong, and home values are continuing to rise.

Regional Differences in Home Prices

While national trends provide a helpful big-picture view, it’s important to remember that home prices can vary significantly by region. Local markets may be experiencing different conditions, so the best way to get a clear understanding of home values in your area is to consult a trusted real estate agent. They can help you interpret local data and give you more insight into what’s happening in your specific market.

Bottom Line

The decrease in the median asking price doesn’t mean home values are falling. Instead, the drop is largely due to the fact that more smaller homes are being listed for sale, which brings down the overall median price. However, when you look at price per square foot, you’ll see that home values are still on the rise.

If you have questions about the housing market in Pennsylvania (PA) or Florida (FL), or what home prices are doing in your area, don’t hesitate to reach out. Understanding the full picture is essential, and we’re here to help you navigate the market confidently.

At Innovative Mortgage Brokers, we’re dedicated to simplifying the mortgage process for homebuyers in Pennsylvania and Florida. With over 15 years of industry experience, we specialize in offering personalized mortgage solutions, competitive rates, and transparent service. Our goal is to provide you with the best options tailored to your financial needs, ensuring a smooth journey toward homeownership. Whether you’re a first-time buyer, looking to refinance, or investing in real estate, we’re here to guide you every step of the way.