Mortgage rate volatility, oil shocks, and why execution matters more than quotes When a war…

Housing Market Reality Check: What Happens During a Recession?

Why a recession doesn’t automatically mean home prices will crash.

There’s been plenty of discussion lately about a potential recession and what it could mean for various sectors of the economy, especially real estate. If you’re a homeowner or planning to buy soon, you’re probably wondering what impact a recession could have on home prices and mortgage rates. Let’s dive into what the historical data reveals.

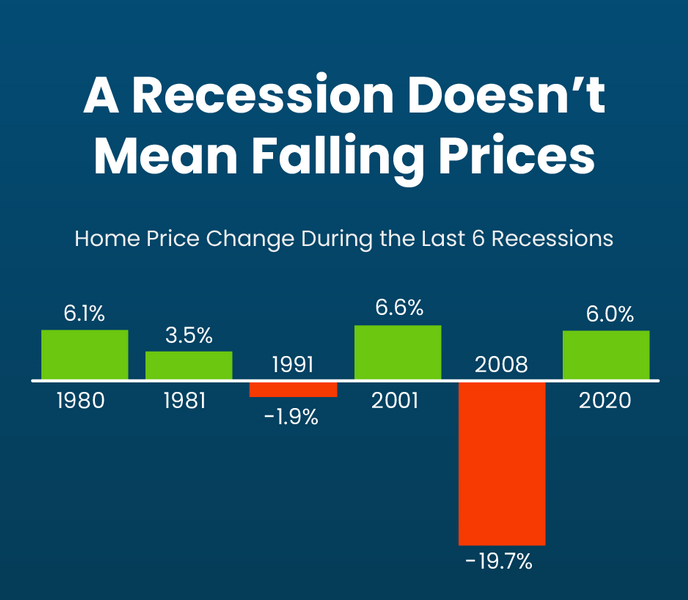

Home Prices and Recessions: Looking at the Facts

You might think that recessions automatically translate to dropping home prices, but that assumption isn’t quite accurate. In fact, when we look at the last six recessions dating back to 1980, only once did home prices experience a significant drop.

Here’s a breakdown of home price changes during recent recessions:

- 1980: Prices actually increased by 6.1%.

- 1981: Home values went up again by 3.5%.

- 1991: There was a slight decrease of -1.9%.

- 2001: Prices rose again, increasing 6.6%.

- 2008: This was the notable exception, with prices dropping -19.7%.

- 2020: Prices bounced back strong, increasing by 6.0%.

Clearly, the devastating housing crash of 2008 was an anomaly rather than a pattern. It was driven primarily by irresponsible lending practices and a financial crisis linked directly to the housing market—conditions that simply aren’t present today. The historical data suggests that, contrary to popular belief, recessions don’t automatically mean home prices will crash.

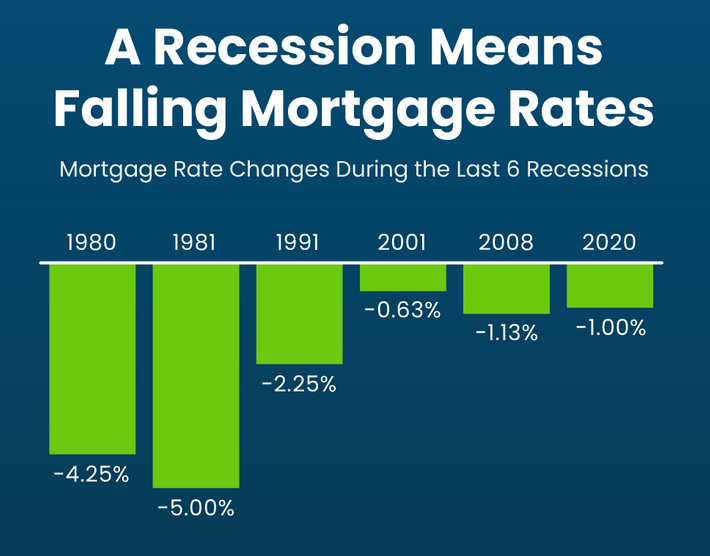

What About Mortgage Rates During a Recession?

Mortgage rates often have a more predictable pattern during economic downturns: historically, rates tend to fall. During recessions, the government often lowers interest rates in an attempt to stimulate economic activity, leading mortgage rates to follow suit.

Here’s a snapshot of mortgage rate changes during past recessions:

- 1980: Rates fell -4.25%

- 1981: Another significant drop of -5.0%

- 1991: Rates decreased by -2.25%

- 2001: A slight dip of -0.63%

- 2008: Rates declined by -1.13%

- 2020: Mortgage rates fell again by -1.0%

As you see, in each recession since 1980, mortgage rates have consistently gone down. While this is great news if you’re considering buying or refinancing, it’s important to set realistic expectations: don’t count on rates dropping back to the ultra-low 3% range we’ve seen recently couple years ago.

Should You Worry About a Recession’s Impact on Housing?

Given the data, a recession doesn’t necessarily mean housing crisis. History demonstrates resilience in the housing market during economic downturns, with prices often holding steady or even rising, and mortgage rates typically declining. This dynamic provides potential homebuyers with unique opportunities—especially those who may have been priced out in times of higher rates or competitive markets.

Of course, nobody can guarantee exactly what will happen during the next economic shift. But based on historical data, fears of a major housing crash simply aren’t supported.

Final Thoughts: Stay Informed and Ready

While a recession can bring uncertainty, it doesn’t automatically mean bad news for homeowners or potential buyers. The best strategy is to stay informed, understand historical trends, and make decisions based on clear information rather than speculation.

If you’re considering buying, selling, or refinancing your home, take time to speak with a mortgage professional who can help you understand your options in today’s economic environment.

About Innovative Mortgage Brokers

At Innovative Mortgage Brokers, we’re committed to empowering homeowners and homebuyers throughout Pennsylvania and Florida with clear, reliable mortgage advice. With over 15 years of experience, we pride ourselves on guiding our clients through the mortgage process with transparency, personalized care, and expert insight. Whether you’re considering purchasing, refinancing, or simply have questions about navigating today’s evolving housing market, we are here to provide the information and support you need every step of the way.