Mortgage rate volatility, oil shocks, and why execution matters more than quotes When a war…

Is the Housing Market About to Crash?

No, the Housing Market Isn’t About to Crash—Here’s What’s Really Happening

If you’ve been watching the news, scrolling social media, or just talking with friends and family lately, there’s a good chance you’ve heard someone ask: “Is the housing market about to crash?”

It’s a fair question. After all, headlines can be dramatic, and memories of 2008 are still fresh for many. In fact, a recent survey from Clever Real Estate revealed that 70% of Americans are worried about a housing market crash in 2025.

But let’s take a step back and look at what’s actually happening in the market. The truth is, we’re not heading for a crash—we’re seeing a market shift. And if you’re a buyer, seller, or even just a homeowner, that shift could work in your favor.

Low Inventory Is Still the Biggest Story

To understand why we’re not in crash territory, we need to talk about supply and demand.

Mark Fleming, Chief Economist at First American, puts it simply:

“There’s just generally not enough supply. There are more people than housing inventory. It’s Econ 101.”

When demand is high and supply is low, prices don’t crash—they go up or at least stay stable. That’s what’s happening right now.

According to Realtor.com, the number of homes for sale is increasing compared to last year—but it’s still way below what we’d consider a balanced or “normal” market. In March 2025, we had around 892,561 active listings, which is up 28.5% from March 2024, but still far below pre-2020 norms.

Just look at the above chart: The 2025 white line is trending upward, but it’s still sitting beneath several previous years (especially 2017–2019, before the pandemic housing boom). That’s important because low inventory is one of the key factors preventing a price collapse.

As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), notes:

“. . . if there’s a shortage, prices simply cannot crash.”

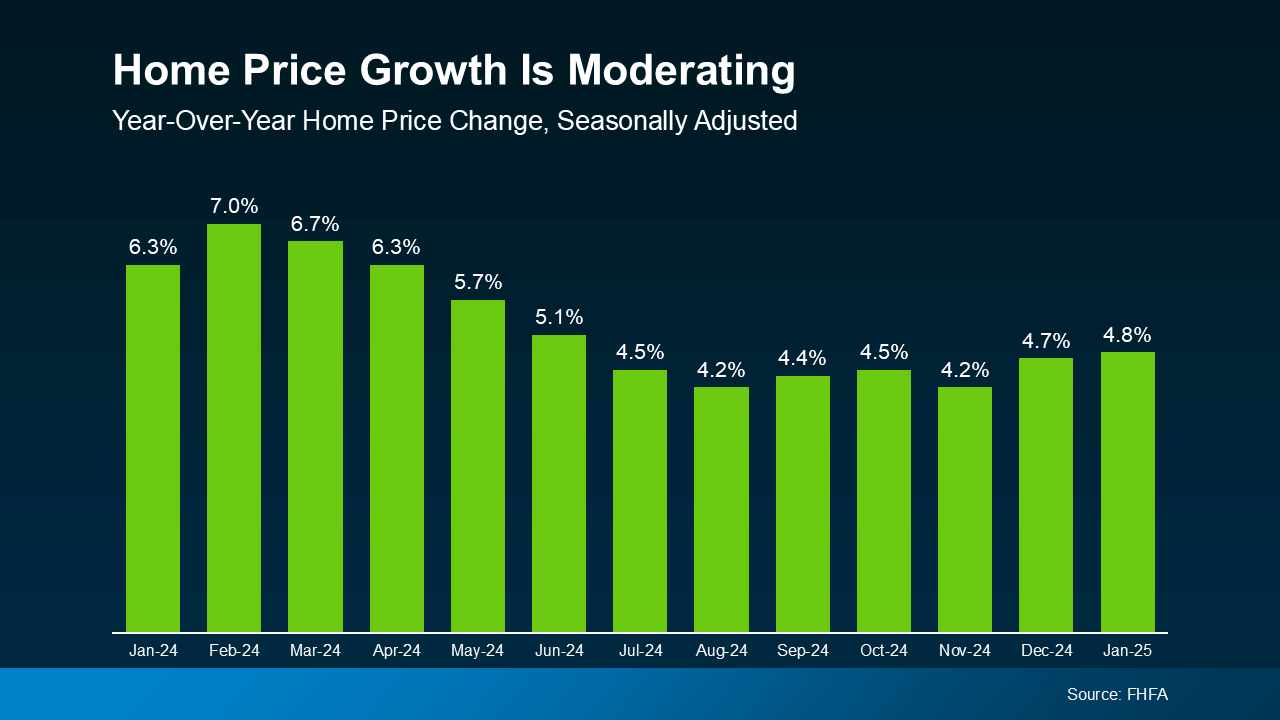

Home Prices Are Still Rising—Just More Slowly

Another sign we’re not in a housing crisis? Home values are still going up.

Yes, the pace of appreciation is moderating, and that’s actually a good thing. For much of 2020 through 2022, prices were climbing at record-breaking speeds. That wasn’t sustainable—and frankly, it was pricing many would-be buyers out of the market.

Now, with more homes hitting the market, that pressure on prices is easing. According to the Federal Housing Finance Agency (FHFA), price appreciation peaked at 7% in February 2024 and has been gradually cooling since. As of January 2025, home prices were still growing at a healthy 4.8% year over year.

This kind of steady, manageable growth is exactly what a healthy market looks like. It allows for affordability to improve slightly while still helping homeowners build equity.

Freddie Mac echoes this in a recent update:

“In 2025, we expect the pace of house price appreciation to moderate from the levels seen in 2024, while still maintaining a positive trajectory.”

Translation: Prices are still going up, just not as fast. And that’s better for everyone in the long run.

The Real Estate Market Is Stabilizing, Not Crashing

If you’re still feeling uncertain, you’re not alone. But let’s be clear: what we’re seeing in today’s market is not a repeat of 2008.

Back then, the market was flooded with risky loans, overbuilding, and artificial demand. Today’s market is supported by:

- Stronger lending standards

- Historically low inventory

- Qualified buyers

- Stable demand from Millennials and Gen Z

As Business Insider recently reported:

“. . . economists who study housing market conditions generally do not expect a crash in 2025 or beyond unless the economic outlook changes.”

That’s a strong vote of confidence from the experts. And while local markets will vary, the national trend is pointing toward stability and long-term strength.

So, What Does This Mean for You?

- If you’re a buyer: The rise in inventory means more options and potentially less competition. And with price growth slowing, you may find opportunities that weren’t there a year ago.

- If you’re a seller: Home values remain strong. Buyers are still motivated, and homes that are priced well are still selling quickly—especially with expert guidance.

- If you’re a homeowner: You’re in a solid position. Home equity is high, values are stable, and demand remains steady.

Bottom Line

Don’t let the headlines scare you.

The data shows that the housing market is not crashing—it’s shifting. With more homes on the market and slower (but still positive) price growth, we’re entering a healthier, more balanced market.

And that’s good news for everyone.

About Innovative Mortgage Brokers

At Innovative Mortgage Brokers, we believe in making the mortgage process simple, personalized, and transparent. With over 15 years of experience, we proudly serve clients across Pennsylvania and Florida—helping first-time buyers, homeowners, and investors secure competitive financing tailored to their unique needs. We leverage the latest technology to streamline your experience while providing the expert, one-on-one guidance you deserve every step of the way. Whether you’re buying, refinancing, or exploring your options, we’re here to help you make confident, informed decisions.