Mortgage rate volatility, oil shocks, and why execution matters more than quotes When a war…

Simplified Closing Costs Are Key: Fannie Mae’s Report Highlights Lender Support

Fannie Mae’s Latest Report: Lenders Find Huge Value in Simplifying Closing-Cost Descriptions

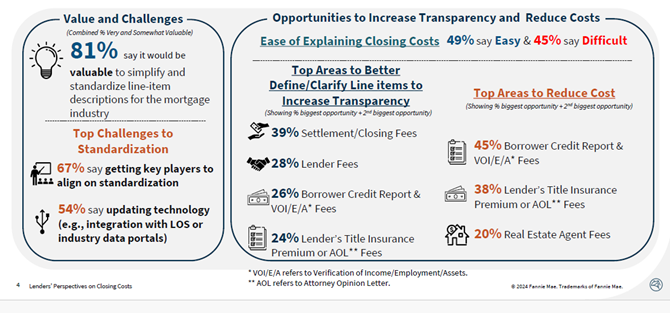

In the world of mortgage lending, closing costs can be a source of confusion and frustration for borrowers. These fees, which often include everything from appraisal costs to title insurance, can vary greatly between lenders, making it difficult for consumers to understand what they’re actually paying for. Fannie Mae’s recent report highlights the importance of simplifying and standardizing closing cost descriptions. This initiative, aimed at making the mortgage process more transparent and user-friendly, is not just beneficial for borrowers, but for lenders as well. In this article, we’ll break down the key findings of the report and explore why clearer, standardized closing cost descriptions are crucial to the future of mortgage lending.

The Problem with Current Closing Cost Descriptions

Currently, closing cost descriptions are often inconsistent and vary from lender to lender. For many borrowers, the closing process can feel like a whirlwind of paperwork, legal jargon, and unexpected fees. Closing costs typically include a mix of lender fees (such as origination and underwriting fees), third-party fees (such as appraisals and title insurance), and other expenses like property taxes and homeowner’s insurance. These fees can range anywhere from 2% to 5% of the loan amount, depending on the lender and location.

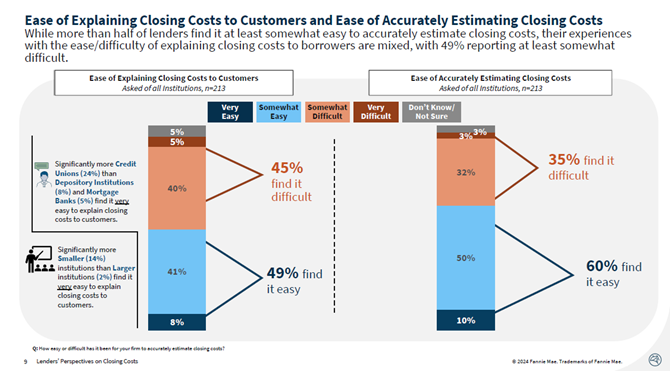

For the average borrower, these costs are hard to navigate because descriptions aren’t standardized. The lack of clarity can lead to frustration, misunderstanding, and sometimes even mistrust between borrowers and lenders. In fact, the Fannie Mae report reveals that consumers are often caught off guard by closing costs, feeling uncertain about where their money is going.

Lenders, on the other hand, are dealing with the complexity of closing costs too. They have to ensure compliance, communicate effectively with third parties, and provide estimates that align with actual costs. The inconsistency in closing cost descriptions adds to this complexity, creating room for errors and disputes down the line.

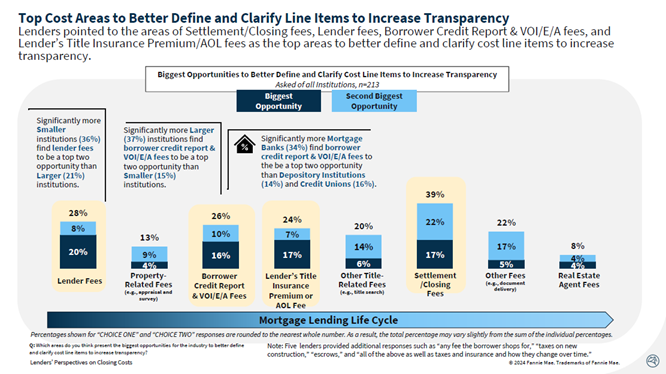

The Case for Simplifying and Standardizing

The Fannie Mae report makes it clear that simplifying and standardizing closing cost descriptions is a win-win for both borrowers and lenders. For borrowers, the benefits are obvious: clearer descriptions of what they’re paying for make it easier to budget and compare offers from different lenders. For lenders, standardized descriptions can help streamline operations, reduce compliance costs, and improve customer satisfaction.

The report suggests that if lenders adopt standardized terms and definitions, it would make it easier for consumers to understand what they’re being charged for. This could include standardizing how lender fees are listed, such as appraisal fees, credit report fees, title services, and so on. By adopting common terminology, lenders could make the closing process far less daunting for the average homebuyer.

Moreover, a standardized system would benefit first-time homebuyers in particular. Without experience in the mortgage process, they are often overwhelmed by the sheer volume of fees and legal terms they encounter at closing. Having a simpler, more transparent process would empower these borrowers, enabling them to make informed decisions with greater confidence.

Real Value for Lenders

From the lender’s perspective, simplifying and standardizing closing cost descriptions is more than just a goodwill gesture; it offers real business benefits. For one, it reduces the likelihood of disputes or confusion at closing, which can save time and money. When borrowers are unclear about what they’re paying for, they’re more likely to question charges, leading to delays or even cancellations.

Additionally, standardizing terms across the industry would reduce the time spent training new employees or educating borrowers. Mortgage loan officers would no longer need to explain varying definitions of common fees or services, allowing them to focus on providing high-quality customer service. This streamlining of operations could also reduce the administrative burden associated with closing, potentially lowering overhead costs for lenders.

The report also notes that transparency fosters trust. Borrowers who feel they are being treated fairly and honestly are more likely to refer their loan officer to friends and family. In an industry where referrals are key, this could have a meaningful impact on a lender’s bottom line.

Challenges to Implementation

While the benefits of simplifying and standardizing closing cost descriptions are clear, the report also acknowledges that implementing such changes is not without its challenges. One of the main hurdles is aligning the interests of various industry players, including lenders, title companies, real estate agents, and regulators. Each group has its own way of doing things, and getting everyone on the same page will take time and effort.

Moreover, updating the technology systems that support the mortgage process is another obstacle. Lenders and third-party service providers will need to adjust their platforms to accommodate standardized descriptions, which could require significant upfront investment. However, the long-term savings in time and reduced errors could more than offset the initial costs.

The Role of Technology

One area where technology can play a crucial role is in automating the closing process. Fannie Mae’s report emphasizes that as the mortgage industry becomes more digitized, there are opportunities to create more streamlined, user-friendly platforms. For example, digital tools could be developed to automatically generate standardized closing cost descriptions, making the process faster and less prone to human error.

Additionally, lenders can use technology to provide clearer breakdowns of closing costs to borrowers. This could take the form of easy-to-read digital documents or interactive tools that allow consumers to see exactly how their closing costs are calculated. By using technology to improve communication and transparency, lenders can make the mortgage process more efficient and more enjoyable for borrowers.

How Borrowers Can Benefit

At the end of the day, the borrower is the one who stands to gain the most from simplifying and standardizing closing cost descriptions. By making the process easier to understand, borrowers can feel more confident about their decisions. They’ll be able to compare offers more effectively, budget more accurately, and avoid surprises at the closing table.

For example, a borrower who is considering offers from two different lenders might find it easier to compare those offers if the closing cost descriptions are standardized. Instead of wading through pages of fine print and trying to decipher unfamiliar terms, they can simply look at the standard list of fees and see which lender is offering the best deal.

Moreover, standardizing closing cost descriptions can help protect borrowers from unexpected charges. In some cases, lenders or third-party providers may tack on additional fees at closing that were not clearly disclosed upfront. A more standardized system could reduce the likelihood of this happening, ensuring that borrowers are not caught off guard by last-minute charges.

About Us

At Innovative Mortgage Brokers, our mission is to simplify the mortgage process while providing personalized solutions that fit each client’s unique financial needs. With over 15 years of experience in the mortgage industry, we specialize in helping homebuyers and homeowners in Pennsylvania and Florida achieve their real estate goals.

Our approach is centered around transparency, trust, and customer service. We provide access to a wide range of loan products, from conventional loans to FHA, VA, USDA, Jumbo, and Non-QM options like DSCR and bank statement loans. Whether you’re a first-time homebuyer, refinancing, or investing in property, we’re here to guide you through every step, offering expert advice and competitive rates. At Innovative Mortgage Brokers, we don’t just help you get a loan—we help you secure the right loan for your financial future.

Our commitment to simplifying the mortgage process and keeping the client’s best interest at the forefront sets us apart from larger, less personal lenders. From live rate updates to personalized consultations, we aim to make homeownership accessible and stress-free. Let us help you make your homeownership dreams a reality!

Conclusion: A Step Toward a Better Mortgage Experience

As the Fannie Mae report points out, simplifying and standardizing closing cost descriptions offers significant benefits for everyone involved in the mortgage process. Borrowers gain transparency, confidence, and peace of mind, while lenders streamline operations, reduce errors, and improve customer satisfaction.

For borrowers, the current system can be overwhelming, especially for first-time buyers. The lack of standardization and clarity often leaves people confused about what they’re paying for and can even lead to financial surprises at closing. Fannie Mae’s push for a more standardized system could eliminate these issues, helping borrowers navigate the process more easily.

Lenders also stand to gain. By simplifying and standardizing their descriptions, they can reduce the administrative burden and provide a more seamless, transparent experience for their clients. As technology continues to evolve, the integration of digital tools will further enhance the mortgage process, creating a clearer, more user-friendly experience.

At Innovative Mortgage Brokers, we’re committed to staying at the forefront of industry changes like these. We believe in transparency, and we’re always looking for ways to simplify the mortgage process for our clients. Whether you’re a first-time homebuyer or refinancing, we’re here to guide you every step of the way.