Mortgage rate volatility, oil shocks, and why execution matters more than quotes When a war…

Think Student Loans Are Blocking Your Home Purchase? You May Be Surprised!

Discover How Your Loans May Not Be the Obstacle You Think!

For many years, student loan debt has been seen as a significant hurdle to homeownership, particularly for younger generations like millennials. The burden of student loans is often cited as a key reason why young adults are delaying major life events, including purchasing a home. However, a recent report by First American presents a more nuanced view of the relationship between student loans and homeownership, suggesting that while student debt may delay the process, it doesn’t necessarily prevent individuals from achieving the dream of owning a home.

This article dives into the findings of the First American report and explores how student loan debt, though a challenge, is not the immovable obstacle many perceive it to be.

Understanding Student Loans in Today’s Economy

Student loan debt has risen sharply over the past few decades, creating significant financial obligations for graduates. According to the First American report, student loan debt has increased from about $200 billion in 2003 to over $1.7 trillion in 2021. With an average borrower carrying about $37,000 in student debt, it’s easy to see why many assume that such financial burdens could prevent homeownership. But the reality is more complex than that.

While student loans certainly impact a borrower’s debt-to-income ratio (DTI), which is a key factor in mortgage approval, they are not the sole determinant of whether someone can afford a home. Other factors, such as income growth, lower student loan interest rates, and longer repayment terms, have helped mitigate the impact of student loans on potential homebuyers. In other words, while student loans add financial pressure, they don’t eliminate the possibility of homeownership.

Payment-to-Income Ratios: A Critical Factor

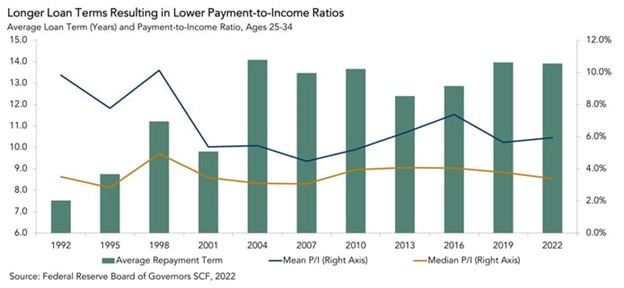

One of the most important insights from the First American report is the declining impact of student loans on the payment-to-income ratio. In 1992, the average repayment term for student loans was around 7.5 years, with interest rates hovering around 8%. Fast forward to 2022, and the average repayment term has nearly doubled to 14 years, with interest rates dropping to about 6%.

These longer repayment terms and lower interest rates mean that the monthly payments on student loans, relative to a borrower’s income, have become more manageable over time. In fact, the report notes that the average monthly student loan payment-to-income ratio has steadily declined, which reduces the overall financial burden for borrowers.

This extended “education-buying power” means that even though student loan balances have increased, borrowers are not necessarily under as much financial strain as they once were. Monthly student loan payments have become more affordable, allowing borrowers to set aside more money for other financial goals, including saving for a down payment on a home.

The Positive Impact of Higher Education on Income

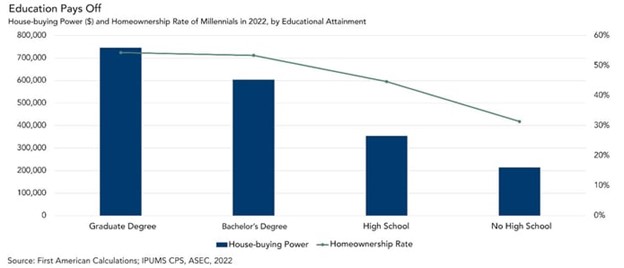

A major takeaway from the report is the correlation between higher education and increased earning potential. While student loan debt can be burdensome, it is also a reflection of the pursuit of higher education, which typically leads to higher income levels. In fact, millennials with a bachelor’s degree or higher earn significantly more than those with only a high school diploma, giving them more buying power in the housing market.

According to the report, millennials with a bachelor’s degree had an estimated $250,000 more in house-buying power compared to those with only a high school diploma. This substantial difference in earning potential translates into greater financial flexibility, allowing those with higher education degrees to overcome the challenge of student loan debt more easily than their less-educated counterparts.

Moreover, the report found that the homeownership rate among millennials with a bachelor’s degree was 12.8 percentage points higher than among those with just a high school education. This demonstrates that, despite carrying student loan debt, those who pursued higher education are still more likely to become homeowners, largely due to their increased earning potential.

The Impact of Delayed Homeownership

While student loans may not prevent homeownership altogether, they can certainly delay the process. Many young adults, particularly those burdened with substantial student loan debt, choose to delay purchasing a home until they feel more financially secure. This delay can be attributed to several factors, including the need to prioritize paying off student debt, saving for a down payment, and improving their credit scores to qualify for a mortgage.

However, the First American report emphasizes that delaying homeownership doesn’t mean giving up on it. In fact, millennials are entering the housing market in large numbers as they reach their prime home-buying years. The report highlights that the homeownership rate for millennials has been steadily increasing, and as of 2021, it stood at 48.1%, up from 39.1% in 2016.

This growing homeownership rate suggests that, while student loans may delay the process, millennials are still becoming homeowners at a pace comparable to previous generations. The difference is that they are doing so later in life, once they have had time to stabilize their finances and reduce their student loan burden.

The Role of Interest Rates and Affordability

Another key factor to consider is the role of mortgage interest rates and housing affordability. In recent years, low mortgage interest rates have helped make homeownership more accessible, even for those carrying student loan debt. The ability to secure a mortgage at historically low rates has allowed many borrowers to offset the financial impact of their student loans.

Additionally, the concept of real house-buying power, which accounts for income levels, mortgage rates, and home prices, is crucial to understanding how student loan borrowers can still afford homes. As millennials continue to see increases in their earnings, their buying power improves, allowing them to enter the housing market despite having student loans.

Conclusion: Student Loans Are Not an Immovable Barrier

The First American report challenges the widespread belief that student loans are preventing homeownership for an entire generation. While student loans may delay homeownership for some, they are not the immovable obstacle that many perceive them to be.

Factors like longer repayment terms, lower student loan interest rates, and increased earning potential from higher education all work together to make homeownership a realistic goal for many borrowers with student debt. In fact, millennials with higher education degrees are more likely to become homeowners, thanks to their greater house-buying power.

In the end, student loan debt is a manageable challenge, not an insurmountable one. As young adults continue to earn more, improve their credit, and benefit from favorable interest rates, the dream of homeownership remains within reach—even for those with student loans.

While it may take time and careful financial planning, homeownership is achievable for many student loan borrowers, proving that education remains one of the best investments a person can make for their future.

About Us

At Innovative Mortgage Brokers, we pride ourselves on providing a seamless, personalized mortgage experience for every client. With over 15 years of industry expertise, we understand that each borrower has unique financial goals and circumstances. Whether you’re a first-time homebuyer, refinancing your existing property, or an investor seeking tailored solutions, we are here to guide you through the process. We offer a wide range of mortgage products, including conventional, FHA, USDA, and Non-QM loans, allowing us to cater to a diverse clientele. Our goal is to simplify what can be a complex process, delivering education, clarity, and peace of mind every step of the way.

Based in Pennsylvania, our commitment to transparency, integrity, and customer satisfaction sets us apart from larger, less personalized lenders. We believe in building long-term relationships with our clients by offering honest advice, competitive rates, and the latest technologies to streamline the mortgage process. At Innovative Mortgage Brokers, our success is measured by your satisfaction, and we’re dedicated to making your homeownership dreams a reality.